HUD-51004 2020-2026 free printable template

Show details

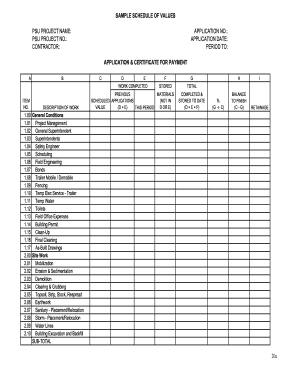

Conviction may result in criminal and/or civil penalties. 18 U.S.C. 1001 1010 1012 31 U.S.C. 3729 3802 Previous editions are obsolete form HUD-51004 3/92 ref. Handbooks 7417. Summary of Materials Stored U*S* Department of Housing and Urban Development OMB Approval No* 2577-0157 exp* 01/31/2014 Office of Public and Indian Housing Public reporting burden for this collection of information is estimated to average 2. 5 hours per response including the time for reviewing instructions searching...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign hud 51004 form

Edit your hud 51004 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HUD-51004 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit HUD-51004. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HUD-51004 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HUD-51004

How to fill out HUD-51004

01

Gather necessary documentation, including income information and personal identification.

02

Obtain the HUD-51004 form from the HUD website or through your local housing authority.

03

Fill in your personal details such as name, address, and contact information in the designated sections.

04

Indicate the type of assistance you are applying for in the relevant fields.

05

Provide family composition details, including names and ages of all household members.

06

Complete the income section by listing all sources of income for each household member.

07

Sign and date the form at the bottom to certify the information is accurate.

08

Submit the completed form to your local Public Housing Agency (PHA) either in-person or by mail.

Who needs HUD-51004?

01

Individuals or families seeking rental assistance through HUD programs.

02

Those applying for public housing or needing a housing choice voucher.

Fill

form

: Try Risk Free

People Also Ask about

What is a HUD 9886 form?

HUD 9886- Authorization for Release. Form along with the HUD Authorization for the Release of Information must be signed by all adult family members. Form is provided to the family at the time of annual re-examination, briefing session, or when family is adding a family member.

What is a HUD 50059?

HB 4350.3 Rev .1. HUD-50059. Owner's Certification of Compliance. with HUD's Tenant Eligibility. and Rent Procedures.

How do I get a copy of my HUD 1 settlement statement?

Where Can I Find My HUD-1 Settlement Statement? If your loan hasn't closed yet, you can get your HUD-1 from your lender. If you've already closed, you should be able to find your HUD-1 settlement statement with your closing documents.

What is HUD 50071?

HUD-50071. Certification of Payments to Influence Federal Transactions. HUD-50072.

What does HUD means?

The Department of Housing and Urban Development is the Federal agency responsible for national policy and programs that address America's housing needs, that improve and develop the Nation's communities, and enforce fair housing laws.

What does HUD mean?

1. head-up display. 2. ( in the US) (Department of) Housing and Urban Development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify HUD-51004 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including HUD-51004, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit HUD-51004 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign HUD-51004 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete HUD-51004 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your HUD-51004, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is HUD-51004?

HUD-51004 is a form used by the U.S. Department of Housing and Urban Development (HUD) to collect data regarding the rental assistance programs. It is specifically for reporting the level of non-federal funding impacting public housing.

Who is required to file HUD-51004?

Public housing authorities (PHAs) that administer rental assistance programs and receive non-federal funding must file HUD-51004.

How to fill out HUD-51004?

To fill out HUD-51004, institutions must provide accurate data reflecting their non-federal funding levels, ensure all required sections are completed, and submit it according to the guidelines established by HUD.

What is the purpose of HUD-51004?

The purpose of HUD-51004 is to track and report the non-federal funding received by public housing authorities, which helps HUD in assessing the financial health and funding needs of these authorities.

What information must be reported on HUD-51004?

HUD-51004 requires reporting of total non-federal funding received, including sources and amounts, as well as details on expenditures related to public housing operations.

Fill out your HUD-51004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HUD-51004 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.